Tokenization: The Process of Converting Assets into Digital Tokens

Asset tokenization is the process of turning a physical asset, such as a car, into a digital token. This process enables participants to hold a digital representation of the asset, which can be traded and used in the same way as the original asset.

Asset tokenization can be used to create new types of financial products, such as cryptocurrency derivatives. It can also be used to raise money through Initial Coin Offerings (ICOs), which are a new way of crowdfunding.

Asset tokenization is being used by companies all over the world to raise money and to create new financial products. Here are some examples:

Ethereum: Ethereum is an open-source platform that allows developers to create dApps (decentralized applications). One example of a dApp is Augur, which is a prediction market platform. Ethereum was used to create the digital token Ethereum Classic, which was used to raise money through an ICO.

Bitcoin: Bitcoin is a decentralized digital currency that was created in 2009 by Satoshi Nakamoto. Bitcoin is used to purchase goods and services online and in physical stores. Bitcoin was used to create the digital token Bitcoin Cash, which was used to raise money through an ICO.

Litecoin: Litecoin is a decentralized digital currency that was created in 2011 by Charlie Lee. Litecoin is used to purchase goods and services online and in physical stores. Litecoin was used to create the digital token Litecoin Cash, which was used to raise money through an ICO.

How Tokenization is Transforming the Blockchain Industry

Tokenization is the process of turning a physical asset, like a security or coin, into a digital token. The value of the token is derived from the underlying asset, not from the number of tokens issued.

Tokens can be used to represent any kind of asset or financial participation. They can be used to access and participate in a platform or network, or to buy goods and services.

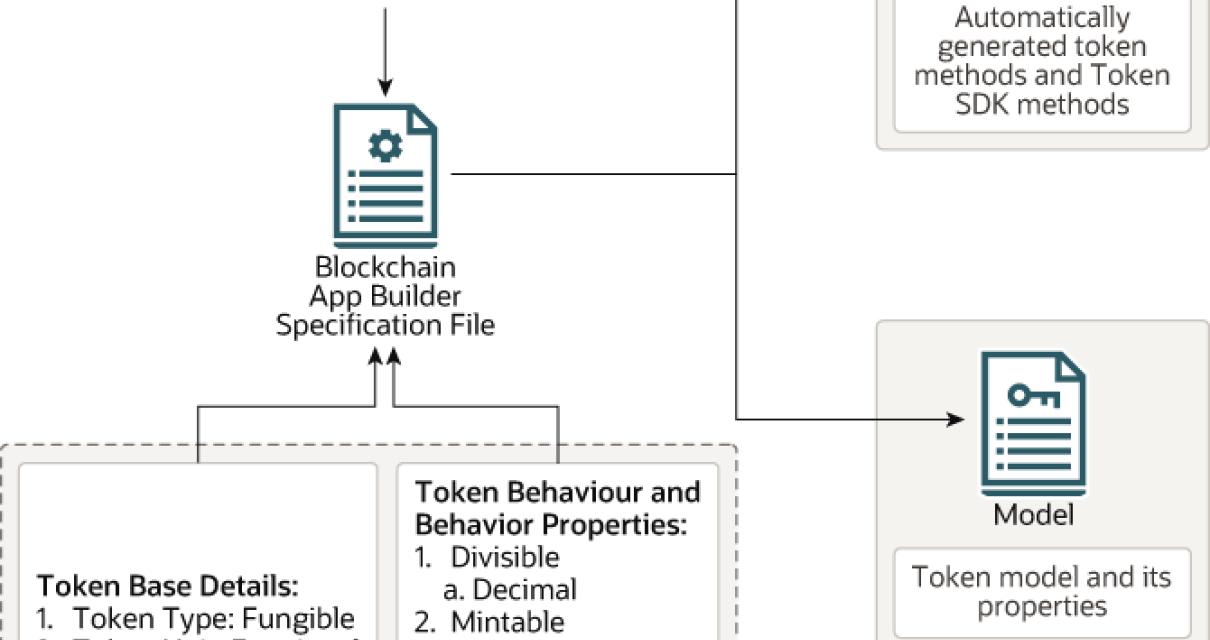

The first step in tokenization is often the creation of a digital asset. This can be a digital representation of an existing asset, like a security or coin, or it can be a new asset altogether.

Once the digital asset is created, it can be distributed to investors. This will create a demand for the token, and it will begin to trade on exchanges.

The value of the token is derived from the underlying asset, not from the number of tokens issued. This means that the value of the token can change over time, depending on the performance of the underlying asset.

Tokenization is revolutionizing the blockchain industry. It allows for the widespread adoption of blockchain technology by allowing for the creation and trading of digital tokens representing real-world assets. This opens up a range of new applications for blockchain technology, including the development of new platforms and the introduction of new financial products.

The Benefits of Tokenization for Businesses and Investors

A token is a digital or virtual asset that uses cryptography to secure its transactions and to control its creation and issuance. Tokens can be used to represent shares, rights, or other assets.

Tokens can provide a new way for people to buy and sell goods and services and to invest in new projects. They can also provide access to services that were not previously available to all people, such as financial products or discounts on tickets.

Tokens can also be used to reward participants in a network or system, or to fund the development of a new project.

The benefits of tokenization for businesses and investors include:

1. Increased efficiency and transparency: Tokens allow businesses to operate more efficiently and transparently. They allow investors to more easily understand the company’s operations and future prospects.

2. Increased access to products and services: Tokens can provide access to products and services that were not previously available to all people. They can also help new projects gain traction and achieve greater success.

3. Increased liquidity and stability: Tokens are often more liquid and stable than traditional investments. This means that they are easier for investors to trade and hold in their portfolios.

4. Greater security: Tokens are often more secure than traditional investments. This means that they are less likely to be stolen or lost.

5. Greater potential for growth: Tokens have the potential to grow much faster than traditional investments. This could lead to greater returns for investors.

How Tokenization Can Secure the Future of Blockchain Technology

Tokenization is a process of turning something into a token, which is essentially a representation of ownership. It can be used to secure the future of blockchain technology by creating a more user-friendly experience for those who want to engage with this new technology.

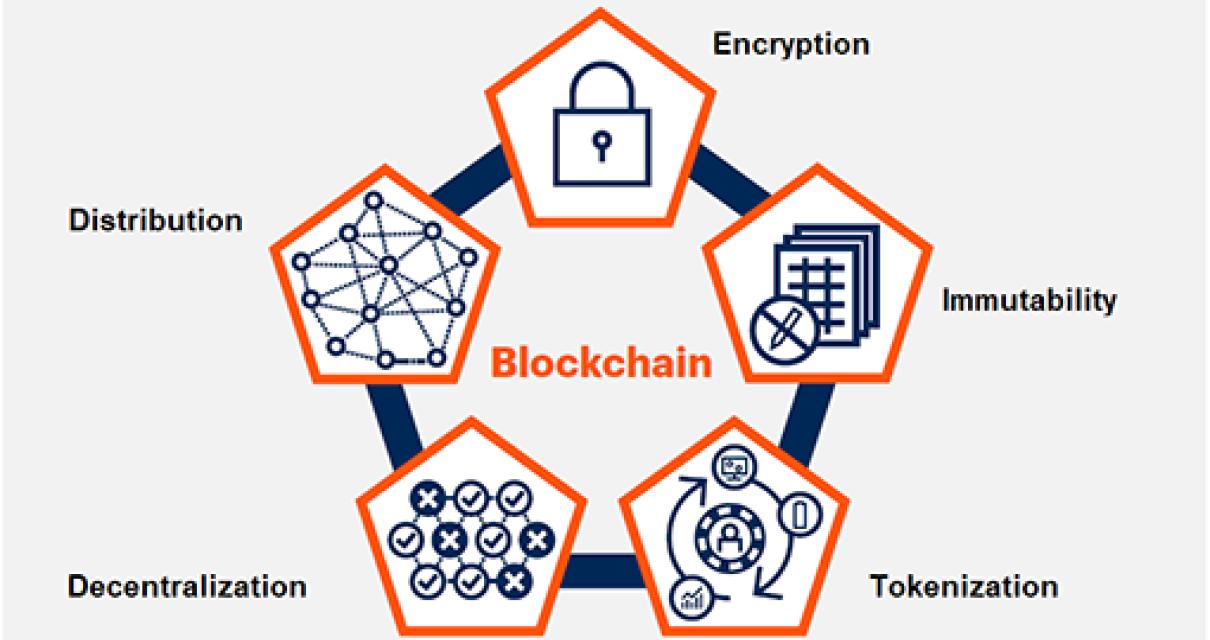

Tokenization can also help to increase the security of blockchain technology by creating a more tamper-proof system. When tokens are created, they are essentially digital assets that cannot be copied or stolen. This makes them a valuable safeguard against fraud and theft, which is why they are increasingly being used in blockchain technologies.

Overall, tokenization is a powerful tool that can help to secure the future of blockchain technology. By creating a more user-friendly experience, tokenization can make it easier for people to engage with this new technology. In addition, tokenization can help to create a more secure system by protecting the data and assets stored on blockchain technology.

The Risks and Challenges of Tokenizing Assets on the Blockchain

There are a few potential risks and challenges associated with tokenizing assets on the blockchain. One potential risk is that the blockchain technology may not be able to handle the increased demand for tokens. Another potential risk is that the tokens may not be worth anything if the underlying assets do not have any value. Finally, there is the risk that the tokens may be scams or frauds.

The Potential of Tokenized Securities in the Blockchain Space

There is a lot of potential in the blockchain space for tokenized securities. One of the key benefits of tokenized securities is that they can provide investors with a way to access assets without having to trust third parties. This can help to reduce the risk of fraud and ensure that all transactions are transparent.

Another advantage of tokenized securities is that they can provide investors with a way to participate in the growth of a company without having to invest in its shares. This can help to boost the value of a company's stock and enable investors to make profits over time.

Overall, tokenized securities offer a number of benefits that could make them a popular option for investors. If developers can find a way to create tokens that are appealing to investors, there is potential for this technology to revolutionize the way securities are traded.

How Asset Tokenization can Power the New Blockchain Economy

Asset tokenization is a process of creating a digital asset out of an existing physical asset. This allows for the creation of new, more efficient and liquid markets for assets.

The benefits of asset tokenization include:

1. Increased liquidity and efficiency: Asset tokenization allows for the creation of more liquid and efficient markets for assets, which can help to increase investor confidence and provide a more efficient way for investors to access and trade assets.

2. Increased investor transparency and trust: Asset tokenization can help to increase investor transparency and trust by creating a digital record of the assets underlying the token. This can help to minimize the risk of fraud and protect investors from shady practices.

3. Increased scalability and flexibility: Asset tokenization can enable the creation of more flexible and scalable markets for assets, which can allow for the development of new financial products and services.

4. Increased security and trust: Asset tokenization can help to increase security and trust by creating a tamper-proof record of the assets underlying the token. This can help to minimize the risk of fraud and protect investors from reckless behavior.

Asset tokenization is an exciting new technology that has the potential to power the new blockchain economy. By creating more liquid and efficient markets for assets, asset tokenization can help to increase investor confidence and provide a more efficient way for investors to access and trade assets.

The Promise of Tokenization in the Era of Blockchain

Tokenization is a process of turning real-world assets or services into tokens. These tokens can be traded on a blockchain-based platform and serve as a means of exchange for goods and services.

The potential benefits of tokenization include:

1. Increased liquidity: Because tokens are tradable, they provide increased liquidity for assets and services. This makes it easier for investors to buy and sell them, which improves market efficiency.

2. Reduced risk: Because tokens are backed by real-world assets or services, they reduce the risk associated with investing in them. This makes them a more attractive option for consumers and businesses alike.

3. Greater trust: Tokenization makes it easier for people to trust the legitimacy of assets and services. This reduces the risk of fraud and mistreatment by companies.

4. Increased transparency: Because tokens are traceable, they provide increased transparency around the transactions that take place between parties. This allows people to understand the origins of assets and ensures that they are being treated fairly.

5. Increased efficiency: Tokenization can help to streamline the processes involved in trading goods and services, which can lead to increased efficiency and reduced costs.

There are several challenges that need to be overcome before tokenization can become a widespread phenomenon. These include:

1. Ensuring that tokens are compliant with existing regulations: To be accepted as a means of exchange, tokens must comply with existing legal and regulatory guidelines. If they are not compliant, this could lead to financial losses for investors.

2. Developing an appropriate ecosystem: The success of tokenization depends on the development of an appropriate ecosystem in which it can be used. This includes the establishment of secure platforms and ecosystems for trading and using tokens.

3. Determining the value of tokens: It is necessary to develop mechanisms for determining the value of tokens. This will ensure that they are appropriately priced and provide a fair return for investors.

There are a number of companies working on developing tokenization technologies. These include:

1. Ethereum: Ethereum is a platform on which tokens can be created and traded. It is also responsible for developing the Ethereum blockchain, which is used to store and track tokens.

2. Waves: Waves is a platform on which tokens can be issued and traded. It is also responsible for developing the Waves blockchain, which is used to store and track tokens.

3. Hyperledger: Hyperledger is a platform on which tokens can be issued and traded. It is also responsible for developing the Hyperledger blockchain, which is used to store and track tokens.