Introduction to Crypto Chart Indicators

Crypto chart indicators are a great way to help you understand the current state of the crypto markets. They can help you identify trends, make informed investment decisions, and more.

There are many different crypto chart indicators out there, and it can be difficult to know which ones to trust. That’s why we’ve put together this introductory guide to help you get started.

In this guide, we will discuss the following topics:

What are crypto chart indicators?

How to use crypto chart indicators

The best crypto chart indicators

What are crypto chart indicators?

Crypto chart indicators are a type of technical analysis tool that can help you identify trends in the crypto markets. They use a variety of data points to make predictions about future market movements.

There are a few different types of crypto chart indicators, including:

candle charts

line charts

area charts

Each type of indicator has its own strengths and weaknesses. It’s important to familiarize yourself with all of the different types of crypto chart indicators so that you can make the most informed investment decisions.

How to use crypto chart indicators

To use crypto chart indicators, you first need to gather some data points. This data can come from market prices, volume, supply and demand, and other factors.

Once you have your data, you can start using the indicators to make predictions about future market movements. You can use these predictions to help you make informed investment decisions.

The best crypto chart indicators

There are a lot of different crypto chart indicators out there, and it can be tough to decide which ones to use. That’s why we’ve put together a list of the best crypto chart indicators.

This list includes:

1. MACD (Moving Average Convergence Divergence) indicator

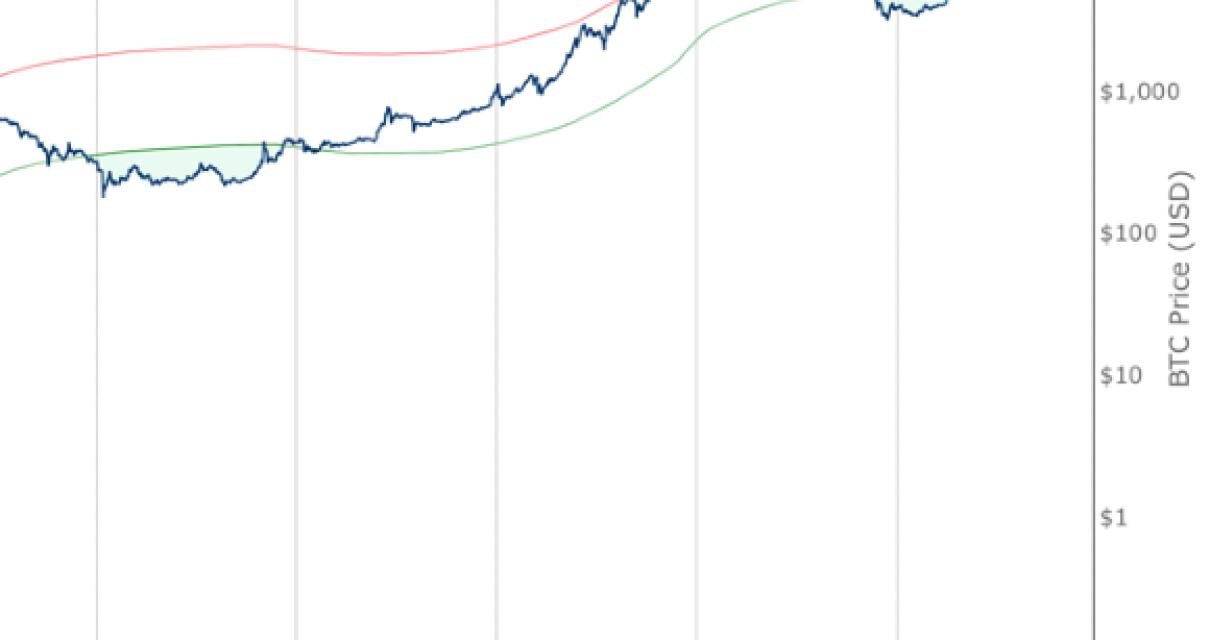

The MACD indicator is one of the most popular crypto chart indicators. It uses two moving averages to make predictions about future market movements. The first moving average is used to calculate the short-term trend, and the second moving average is used to calculate the long-term trend.

2. RSI (Relative Strength Index) indicator

The RSI indicator is another popular crypto chart indicator. It helps you identify overbought and oversold conditions in the markets. Overbought conditions indicate that the market is overheating, and oversold conditions indicate that the market is falling too fast.

3. CCI (Cyclical Chaikin Money Flow) indicator

The CCI indicator is used to identify long-term trends in the markets. It uses four different data points to make predictions about future market movements. These data points include: price, volume, open interest, and supply and demand.

4. ADX (Advanced Technical Analysis) indicator

The ADX indicator is used to identify trend changes in the markets. It uses five different data points to make predictions about future market movements. These data points include: MACD, RSI, CCI, Stochastic Oscillator, and Bollinger Bands.

What are the most popular crypto chart indicators?

The most popular crypto chart indicators are the MACD, Bollinger Bands, and RSI.

How to use crypto chart indicators to your advantage

Crypto chart indicators are a great way to help you track the performance of a cryptocurrency. They can provide you with information about how a specific cryptocurrency is performing, and can help you make informed decisions about whether or not to buy or sell it.

Some of the most common crypto chart indicators include the following:

The MACD indicator

The RSI indicator

The stochastic indicator

The Fibonacci retracement indicator

The volume indicator

The MACD indicator

The MACD is a popular crypto chart indicator that helps you track the movement of a cryptocurrency's price over time. The MACD indicator consists of two lines, the MACD histogram (top line) and the MACD signal line (bottom line).

The MACD histogram shows the amount of positive and negative movement in a cryptocurrency's price over time. The MACD signal line indicates whether the price is rising or falling.

The MACD indicator is useful for tracking the overall trend of a cryptocurrency, and can help you make informed decisions about whether or not to buy or sell it.

The RSI indicator

The RSI (relative strength index) indicator is a popular crypto chart indicator that helps you measure the strength of a cryptocurrency's current price compared to its historical prices.

The RSI indicator ranges from 0 to 100, and is useful for tracking the overall momentum of a cryptocurrency's price. When the RSI is close to 100, it indicates that the price is stable and has not experienced much movement over the past few days or weeks. When the RSI is lower than 50, it indicates that the price is experiencing significant movement and is likely to continue moving in that direction.

The stochastic indicator

The stochastic indicator is a popular crypto chart indicator that helps you track the volatility of a cryptocurrency's price over time. The stochastic indicator ranges from 0 to 100, and is based on the theory that markets tend to move in cycles.

When the stochastic indicator is close to 100, it indicates that the price is experiencing high levels of volatility and is likely to continue moving in that direction. When the stochastic indicator is lower than 50, it indicates that the price is experiencing low levels of volatility and is likely to trend in that direction.

The Fibonacci retracement indicator

The Fibonacci retracement indicator is a popular crypto chart indicator that helps you identify areas of potential support and resistance in a cryptocurrency's price.

The Fibonacci retracement indicator uses the Fibonacci sequence to identify areas of support and resistance in a cryptocurrency's price. When the price moves above or below the area identified by the Fibonacci retracement indicator, it indicates that there is potential for further price movement in that direction.

The volume indicator

The volume indicator is a popular crypto chart indicator that helps you track the amount of trading activity in a cryptocurrency's market over time.

The volume indicator ranges from 0 to 100, and is based on the theory that when more people are buying or selling a cryptocurrency, its price will be higher. When the volume indicator is close to 100, it indicates that there is a lot of trading activity going on in the market and that the price of a cryptocurrency is likely to continue moving in that direction.

The benefits of using crypto chart indicators

Crypto chart indicators provide traders with a way to quickly and easily identify potential areas of price action that may be worth exploring. By using these indicators, traders can make informed decisions about whether or not to trade based on the current market conditions.

Some of the benefits of using crypto chart indicators include:

The top 5 crypto chart indicators for beginners

1. Price analysis

One of the simplest and most effective ways of analyzing crypto charts is by looking at the price action. By tracking changes in the price of a cryptocurrency over time, you can get a good idea of how the market is performing and whether there are any obvious trends.

2. Volume analysis

Another important factor to consider when analyzing crypto charts is volume. By measuring the amount of activity happening on a particular cryptocurrency exchange, you can get an idea of how popular the coin is and whether there are any signs of market saturation.

3. Technical indicators

If price analysis isn’t your thing, you can also look to technical indicators for guidance. These indicators are designed to help you identify potential trends in the market and make informed investment decisions.

4. Social media activity

Finally, don’t forget to keep an eye on social media activity when analyzing crypto charts. Not only will this provide you with valuable insights into the general sentiment of the market, but it can also help you identify potential pump and dump schemes.

5. Conclusion

Once you’ve got a basic understanding of how to read crypto charts, you can start to look for signs of volatility and trendiness, which will help you make more informed investment decisions.

The top 5 crypto chart indicators for experienced traders

1. MACD – The MACD indicator is a technical analysis tool that helps traders identify bullish and bearish trends in the market.

2. RSI – The RSI indicator is used to measure the strength and momentum of a market.

3. CCI – The CCI indicator is used to identify overbought and oversold conditions in the market.

4. ADX – ADX is a technical analysis tool that helps traders identify if a market is trending or not.

5. Gann Fan Chart – The Gann Fan Chart is used to identify overbought and oversold conditions in a market.

The difference between lagging and leading indicators

Lagging indicators are indicators that show trends after the event has already occurred. They are often less accurate than leading indicators, which are indicators that show trends before the event occurs.

How to use volume indicators in your trading

Volume indicators are a great way to help you make better trading decisions. Volume provides you with an indication of how active the market is. When the market is active, it means that there is a lot of buying and selling going on. When the market is inactive, it means that there is not as much activity.

To use volume indicators in your trading, first figure out what you are looking for. Some common volume indicators are the S&P 500 volume-weighted index (VIX), the Dow Jones Industrial Average volume-weighted index (DIAV), and the Nasdaq Composite volume-weighted index (IXIC).

Once you have figured out what you are looking for, you need to find a volume indicator that is relevant to your trading strategy. For example, if you are a day trader, you might want to use the DIAV. If you are a long-term investor, you might want to use the VIX.

Once you have found a volume indicator that is relevant to your trading strategy, you need to figure out how to use it. One way to use a volume indicator is to use it as a signal. When the volume indicator is high, this usually means that the market is active and that there is a lot of buying and selling going on. When the volume indicator is low, this usually means that the market is inactive and that there is not as much activity.

Another way to use a volume indicator is to use it as a support or resistance level. When the volume indicator is near the support or resistance level, this usually means that the market is about to make a change. When the volume indicator is far away from the support or resistance level, this usually means that the market is not about to make a change.

What do RSI and MACD tell you about a coin?

RSI and MACD are both indicators that help traders make trading decisions. RSI is a Relative Strength Index, which measures the momentum of a security over a specified period of time. MACD is a Moving Average Convergence/Divergence indicator that helps identify trend changes.

How to interpret Bollinger Bands

Bollinger Bands are a technical analysis indicator that shows the range of prices for a security or commodity over a given period of time. The bands are typically constructed from two standard deviation values, with the upper band representing prices that are above the average and the lower band representing prices that are below the average. When prices move outside of the bands, this is considered to be an indication of volatility and potential price changes.

How moving averages can help your trading

Moving averages are a popular technical analysis tool that can be used to help you trade stocks, futures, and other financial instruments.

A moving average is simply a mathematical calculation that shows the average price (or closing price) of a security or other financial instrument over a certain number of periods. The length of the period used in calculating the moving average may vary, but most moving averages are calculated over a period of days, weeks, or months.

When you use a moving average to make trading decisions, you may use it to help identify trends in a security or other financial instrument. You may also use it to help predict future prices.

There are many different types of moving averages, and each has its own advantages and disadvantages. Some common types of moving averages include the simple moving average (SMA), the exponential moving average (EMA), the weighted moving average (WMA), and the short-term Moving Average Convergence Divergence (MTMACD).

Using Ichimoku Cloud to find support and resistance

levels

Ichimoku Cloud uses five levels of support and resistance. These are represented by horizontal lines on the chart. The first line, called the "lower limit," is the lowest point of the cloud and signals a support level. The second line, called the "upper limit," is the highest point of the cloud and signals a resistance level. The third line, called the "midpoint," is the average price between the lower limit and the upper limit. The fourth line, called the "threshold," is the price at which a move from the lower limit to the upper limit is considered a "breakout." The fifth line, called the "breakout point," signals a buy or sell decision.

To find support and resistance levels on the Ichimoku Cloud, use the following guidelines:

If the lower limit is below the midpoint, look for support levels near the lower limit.

If the upper limit is above the midpoint, look for resistance levels near the upper limit.

If the lower limit is above the midpoint and the breakout point is above the threshold,look for support levels near the upper limit.

If the lower limit is below the midpoint and the breakout point is below the threshold,look for resistance levels near the lower limit.