How Bankers Are Using Blockchain Technology

The blockchain technology is being extensively used by bankers. Banks are using the blockchain technology to improve the efficiency of their operations.

Banks are using the blockchain technology to create a tamper-proof record of all transactions. This is important because it eliminates the need for third parties to verify transactions.

Banks are also using the blockchain technology to create a decentralized system. This system eliminates the need for a central authority to manage transactions.

Banks are also using the blockchain technology to create a system that is secure. This system is important because it eliminates the risk of fraud.

What Blockchain Technology Means for the Banking Industry

There is no doubt that blockchain technology has the potential to revolutionize the banking industry. Blockchain is a distributed database that allows for secure, transparent and tamper-proof transactions. This technology could be used to create a tamper-proof record of all financial transactions, which could eliminate the need for third-party verification. Additionally, blockchain could be used to create a system where customers can directly interact with banks to make payments and track their accounts. Finally, blockchain technology could be used to create a system where banks can share data with one another to improve their overall operations.

The Benefits of Blockchain Technology in Banking

There are a number of benefits to using blockchain technology in banking. These benefits include the ability to create a secure, tamper-proof record of transactions, increased transparency and security, and reduced costs.

Blockchain technology can help banks reduce costs by eliminating the need for third-party intermediaries. This can reduce the costs of processing transactions, as well as the costs associated with compliance requirements.

Blockchain technology can also help banks improve transparency and security. By providing a secure and tamper-proof record of transactions, banks can increase trust among their customers and employees. This can lead to increased efficiency and decreased costs associated with fraud and security breaches.

Finally, blockchain technology can help banks to expand their reach into new markets. By creating a secure and transparent record of transactions, banks can provide services to customers in new geographic areas. This can lead to increased revenue and growth for banks.

How Blockchain Can Help Banks Save Money

One of the primary benefits of blockchain technology is its ability to streamline processes and save banks money. A study by PwC found that if 10 percent of banks adopted blockchain technology, they could save up to $8 billion annually in operational costs. By automating processes and reducing the need for human input, blockchain technology can help banks reduce the need for costly HR, training, and financial management resources. Additionally, by reducing the need for third-party verification and settlement processes, blockchain technology can help banks save on costs associated with clearing and settling transactions.

Why Blockchain is Good for Banking

When it comes to blockchain technology, banks are seeing a lot of potential. Cryptocurrencies have been making waves lately, and many people are wondering what impact they will have on the banking sector.

At first glance, it might seem like blockchain could be bad for banks. After all, this technology is often associated with cryptocurrencies like Bitcoin and Ethereum. But that’s not always the case.

In fact, blockchain technology can be very beneficial to banks. Here are four reasons why:

1. Security

One of the biggest benefits of blockchain technology is its security. When transactions are recorded on a blockchain, it creates an immutable record. This means that banks can be sure that all of their data is reliable and secure.

2. Transparency

Another benefit of blockchain technology is its transparency. Everyone who participates in a blockchain network can see all of the transactions that have taken place. This makes it difficult for anyone to tamper with the data.

3. Speed

One of the most important benefits of blockchain technology is its speed. Transactions on a blockchain are typically completed in minutes rather than hours or days. This makes it a perfect solution for businesses that need to move large amounts of money quickly.

4. Cost savings

Finally, blockchain technology can save banks a lot of money. Because transactions are recorded on a blockchain, banks no longer need to rely on middlemen like banks or credit card companies. This saves them money on fees and other costs.

How Blockchain Will Change Banking

The technology behind blockchain is a distributed database that allows for secure, tamper-proof, and transparent transactions. This technology offers banks and other financial institutions a more efficient way to conduct transactions, reduce costs, and improve transparency.

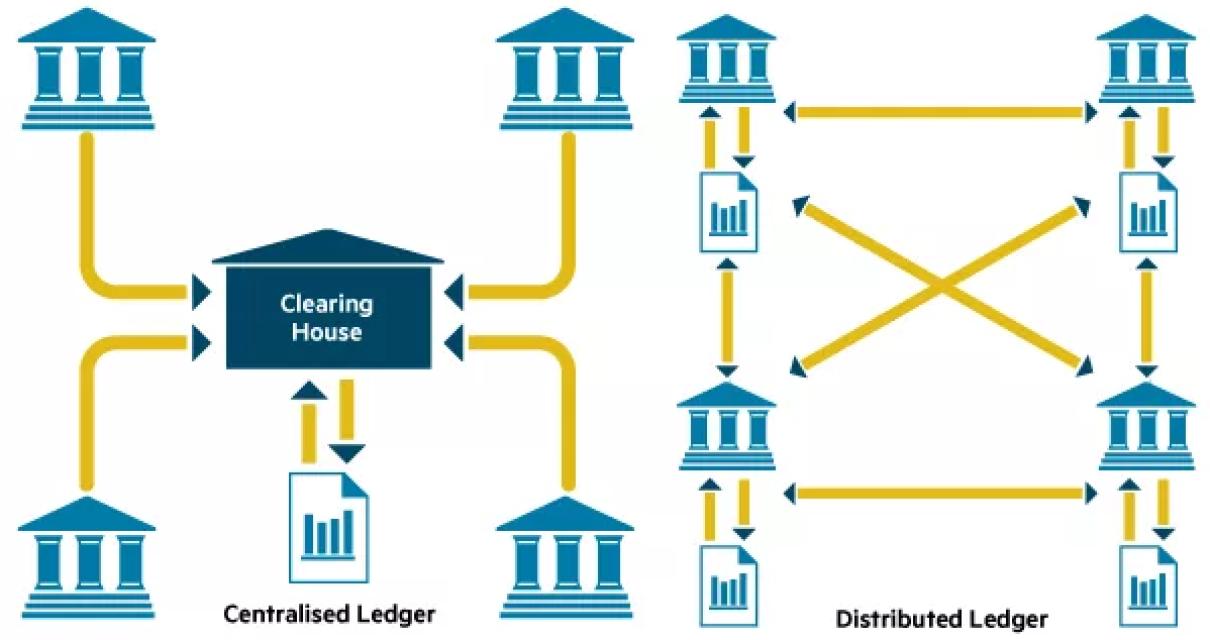

Banks are currently using centralized databases to store information about customers and transactions. This system can be vulnerable to cyberattacks and fraud. Blockchain offers a more secure and efficient way to store this information.

Blockchain can also be used to create a digital ledger of all transactions. This ledger is accessible by all participants in the network and can be used to track the movement of money and assets. This system could improve transparency and accountability in the financial system.

It is unclear how blockchain will change the banking industry completely. However, it is likely that it will revolutionize the way banks operate and interact with their customers.

The Future of Banking with Blockchain Technology

The future of banking with blockchain technology is looking very bright. With so many companies and industries currently exploring the possibilities that blockchain technology offers, it is clear that this is a technology that has a lot of potential.

One of the most important aspects of the future of banking with blockchain technology is the security of data. Currently, banks are very dependent on the security of their data, and blockchain technology can help to ensure that this remains a priority.

Another important aspect of the future of banking with blockchain technology is the ability to create a more efficient system. Currently, banks are very slow when it comes to processing transactions, and blockchain technology can help to speed up this process.

Overall, the future of banking with blockchain technology looks very promising. It is clear that this is a technology that has a lot of potential, and it is likely that we will see a lot more progress made in this area in the near future.

How Banks Can Use Blockchain to Fight Fraud

Banks can use blockchain technology to fight fraud. In particular, blockchain can be used to track the origin of funds, prevent money laundering, and detect fraudulent activities.

By using blockchain, banks can protect their customers and assets from fraud. For example, blockchain can be used to track the origin of funds, preventing money laundering, and detecting fraudulent activities. In addition, blockchain can help banks reduce the costs associated with fraud monitoring and prevention. Overall, using blockchain to fight fraud can be a powerful tool for banks.

The Potential of Blockchain Technology in Banking

One of the biggest potential benefits of blockchain technology in banking is that it could make transactions more secure. By creating a tamper-proof ledger of all transactions, banks could avoid the costly and time-consuming process of investigating and resolving fraudulent activity. Additionally, blockchain technology could help to cut down on the number of red tape and bureaucracy associated with traditional banking procedures.

Another potential benefit of blockchain technology in banking is that it could help to reduce costs associated with transactions. By automating the process of recording and verifying transactions, banks could reduce the amount of manpower and resources required to conduct transactions. This could save banks both money and time, which could lead to increased efficiency and profitability.

Overall, blockchain technology has the potential to revolutionize the way banks operate and conduct transactions. By streamlining and automating various banking processes, blockchain technology could lead to significant savings for banks and increased efficiency and security for customers.

How Blockchain Could Help Banks Serve Customers Better

Banks could use blockchain to improve the way they serve customers. For example, by using blockchain to track customer data, banks could be sure that the information they collect about customers is accurate and up-to-date. This could help banks better understand customers' needs and preferences, and provide them with better service.

Blockchain could also help banks better manage customer relationships. For example, banks could use blockchain to keep track of customer repayments and transactions. This could help banks avoid unnecessary financial penalties and keep track of customers' creditworthiness.

Overall, blockchain could help banks better serve their customers by improving the accuracy of customer data, managing customer relationships more effectively, and avoiding financial penalties.

The Risks of Adopting Blockchain Technology in Banking

There are a few risks associated with adopting blockchain technology in banking. The first risk is that blockchain technology is still in its early stages, and there is still some uncertainty about its potential. This could lead to problems with the system's functionality or security.

Another risk is that blockchain technology is not easily scalable. This means that it can be difficult to implement and maintain a large blockchain system, which could impact its overall effectiveness. Finally, blockchain technology is still relatively new, and there is a risk that it may not be widely adopted by banks or other financial institutions. If this happens, it could limit its usefulness in the long term.

What Bankers Need to Know About Blockchain Technology

There are a few key things that bankers need to know about blockchain technology.

1. Blockchain is a distributed database that allows for secure, transparent and tamper-proof transactions.

2. Transactions are recorded in blocks and then linked together using cryptography.

3. Transactions are verified by network nodes and then added to the blockchain ledger.

4. Bitcoin, the first and most well-known application of blockchain technology, was created in 2009.

5. Other applications of blockchain technology include Ethereum and ripple.