Blockchain: The Future of Finance

What is blockchain?

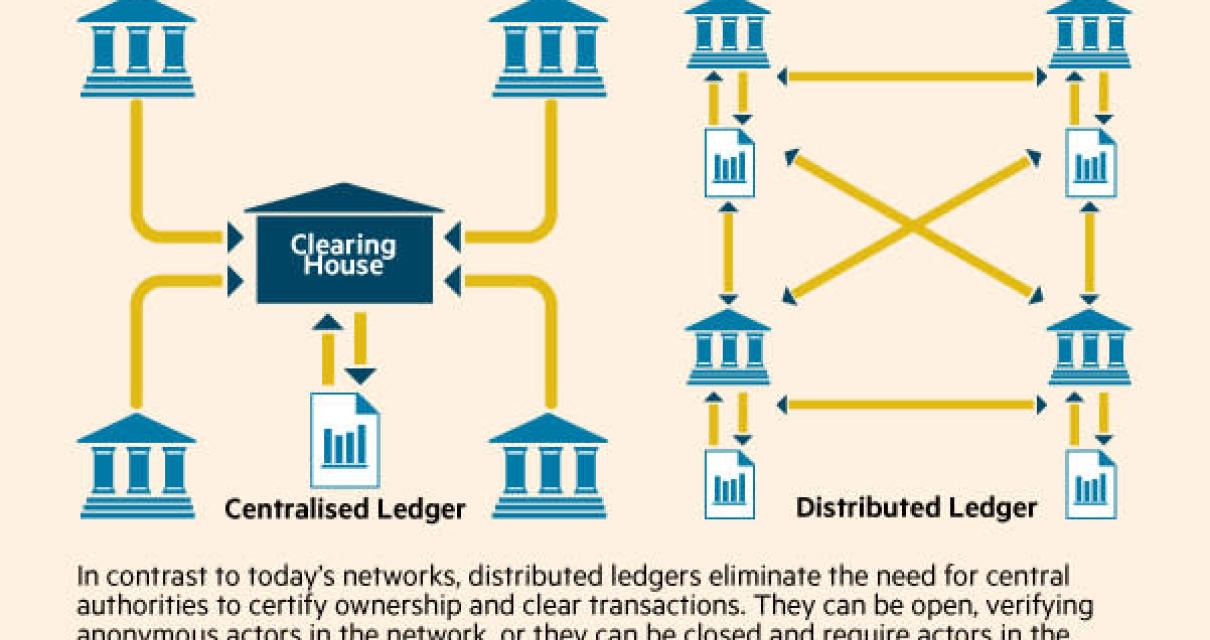

Blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as “completed” blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin nodes use the block chain to distinguish legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

Why is blockchain important?

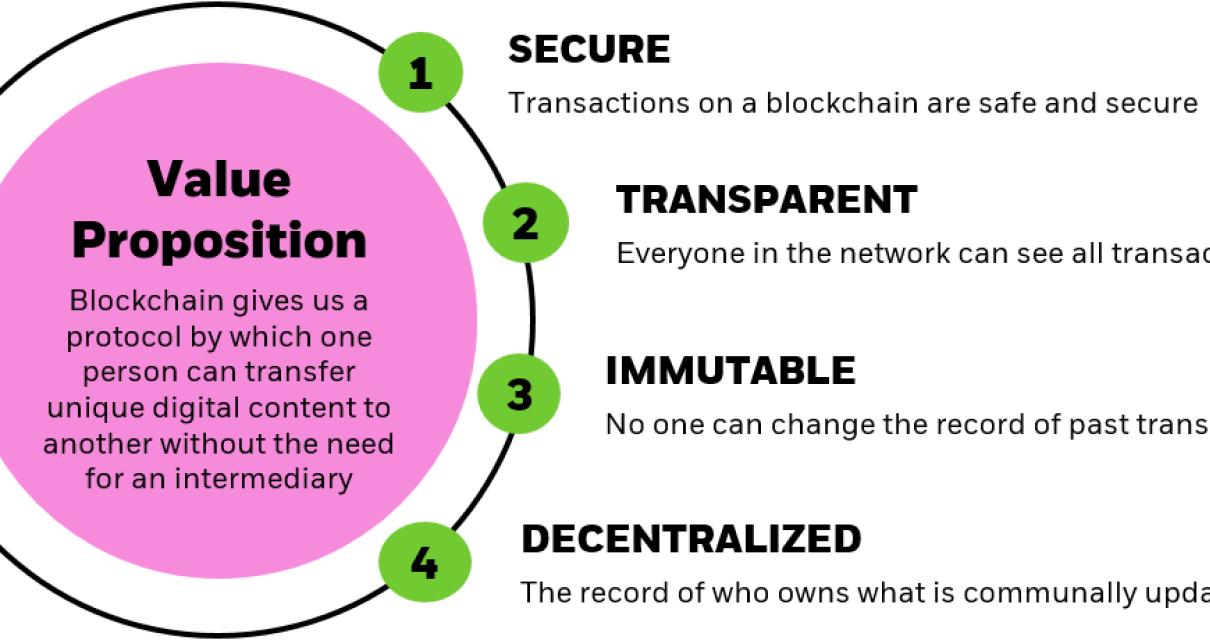

There are several reasons why blockchain is important. First, it allows for secure, transparent and tamper-proof recordkeeping. This makes it ideal for use in financial institutions, as well as other industries that require high levels of trust and transparency. Second, blockchain technology can help reduce costs associated with traditional financial systems. For example, it could enable banks to reduce the number of times they need to verify a transaction. Finally, blockchain could have a significant impact on the way the world economy works. For example, it could help reduce the amount of time it takes to conduct transactions between different countries.

How Blockchain is Transforming the Financial Industry

The blockchain technology has the potential to revolutionize the financial industry. The reason for this is that it can help to create a more secure and transparent system for transactions.

One of the primary benefits of using blockchain technology in the financial sector is that it can help to create a more secure system for transactions. This is because blockchain is a distributed ledger system that is designed to be tamper-proof. This means that it is impossible for anyone to tamper with the information contained on the blockchain network.

Another benefit of using blockchain technology in the financial sector is that it can help to create a more transparent system. This is because blockchain is a digital record of all transactions that take place on the network. This means that everyone involved in a transaction can see the details of the transaction, including the time and date of the transaction.

Overall, blockchain technology has the potential to revolutionize the financial industry. This is because it can help to create a more secure and transparent system for transactions. Additionally, blockchain technology can help to create a more transparent system for transactions, which can help to reduce the risk of corruption.

The Benefits of Blockchain for Financial Institutions

There are many benefits to blockchain technology for financial institutions. These include:

1. Reduced Costs

One of the main benefits of blockchain technology is that it can reduce costs associated with traditional banking systems. This includes the costs of processing transactions, maintaining records, and providing customer services.

2. Improved Security

Another benefit of blockchain technology is that it can improve security for financial institutions. This is because blockchain is a distributed database that is secure by design. This means that it is difficult for anyone to tamper with the data stored on blockchain networks.

3. Increased Transparency

Another benefit of blockchain technology is that it can increase transparency for financial institutions. This is because blockchain networks are decentralized, which means that all data stored on them is public. This makes it easier for people to understand how financial institutions are performing and to track any fraudulent activity.

4. Reduced Fraud

One of the main benefits of blockchain technology is that it can reduce fraud in financial institutions. This is because blockchain networks are secure by design and are decentralized, which makes it difficult for anyone to hack into them. This reduces the risk of financial losses caused by fraud.

How Blockchain Can Improve Financial Inclusion

There are a number of ways that blockchain technology can improve financial inclusion.

1. Blockchain can help to eliminate the need for a middleman in financial transactions. This can help to reduce the cost of transactions and make them more accessible to a wider range of people.

2. Blockchain can help to ensure the accuracy and legitimacy of financial transactions. This can help to reduce the risk of fraud and theft, and ensure that money is being spent where it is supposed to be spent.

3. Blockchain can help to reduce the time required to complete financial transactions. This can help to improve the speed and efficiency of the financial system, which can benefit both consumers and businesses.

4. Blockchain can help to create a more secure and transparent financial system. This can help to protect consumers from fraud and theft, and ensure that money is being spent where it is supposed to be spent.

5. Blockchain can help to reduce the costs associated with financing the development of new businesses. This can help to promote entrepreneurship and innovation, and improve access to funding for businesses of all sizes.

The Potential of Blockchain in Financial Services

While blockchain technology is still in its early days, there are a number of potential applications for it in financial services.

One application is in the realm of cross-border payments. With blockchain, there is a greater transparency and security than is possible with traditional methods, such as sending money through a bank. This could reduce the cost and time it takes to make a payment, and could also help to prevent fraud.

Another potential application for blockchain in financial services is in the area of asset management. With blockchain, there is a greater transparency and security than is possible with traditional methods, such as investing in stocks or bonds. This could allow people to invest more easily and securely, and could also reduce the amount of time needed to make a decision about a investment.

Finally, blockchain technology could be used to improve the process of lending money. Currently, the process of lending money can be time-consuming and complicated, which can lead to delays in making a loan and higher costs for borrowers. With blockchain, this process could be streamlined and made more efficient.

How Blockchain Could Help Fix the Broken Banking System

It is no secret that the banking system is in a lot of trouble. Many people are looking for ways to fix it, and blockchain may be one solution.

Blockchain technology is a distributed database that allows for secure, transparent, and tamper-proof transactions. It was first developed as part of the Bitcoin cryptocurrency system, but it has since been used in a variety of other applications.

There are a number of potential benefits of using blockchain in the banking system. For example, it could help to reduce the risk of fraud and financial theft. It could also help to reduce the costs of processing transactions and provide more secure and reliable information sharing between banks.

If implemented correctly, blockchain could help to improve the overall efficiency of the banking system and make it more secure. It is still early days for blockchain technology, so there is plenty of room for improvement. However, if things progress as planned, it could one day play a major role in fixing the broken banking system.

The Promise of Blockchain for Financial Markets

Blockchain technology has the potential to revolutionize the financial markets by providing a secure and transparent platform for transactions.

The main benefits of using blockchain technology in the financial markets include:

1. Increased transparency and security: Blockchain technology creates a tamper-proof record of all transactions, which eliminates the need for third-party verification. This increases transparency and security, making it easier for investors to verify the legitimacy of a transaction and reduce the risk of fraud.

2. Reduced costs and increased efficiency: Blockchain technology can reduce the costs associated with transferring money across borders, including fees associated with traditional banking systems. It also allows for faster and more efficient transactions, which could lead to lower trading costs and increased profitability for financial institutions.

3. Increased trust and confidence: Blockchain technology is built on a distributed ledger system that is fundamentally trustless. This allows for a more secure and transparent global financial system, which could lead to increased trust and confidence in the financial markets.

How Blockchain Can Make Financial Transactions More Secure

A blockchain is a digital ledger of all cryptocurrency transactions. It is constantly growing as “completed” blocks are added to it with a new set of recordings. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. Bitcoin nodes use the block chain to differentiate legitimate Bitcoin transactions from attempts to re-spend coins that have already been spent elsewhere.

The blockchain is inherently secure because it is decentralized, meaning there is no central point of attack. Each user runs their own node on their computer, which checks the validity of each block before allowing the next to be added to the chain. This process makes it extremely difficult for anyone to tamper with the blockchain, as they would need to control more than half the network’s total computing power.

The benefits of using a blockchain for financial transactions are manifold. First, it eliminates the need for a trusted third party, such as a bank, in order to make transactions. This is great for users who want to avoid having to trust institutions that could be susceptible to fraud or political interference. Additionally, the blockchain is immune to the type of data breaches that have plagued major banks in the past.

By using a blockchain, businesses can also reduce the time it takes to process transactions. This is because the blockchain is a distributed system, meaning that there is no need for a centralized authority to verify and approve transactions. In fact, because the blockchain is immutable, businesses can be sure that all transactions will be recorded and cannot be altered or deleted without detection.

Overall, the benefits of using a blockchain for financial transactions are numerous and profound. By eliminating the need for a third party and providing a tamper-proof record of transactions, the blockchain offers a much more secure way to conduct business.

The Use of Blockchain in Financial Regulation

A blockchain is a distributed database that maintains a continuously growing list of ordered records called blocks. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. The blockchain is constantly growing as “completed” blocks are added to it with a new set of recordings. Each node on the network runs a copy of the blockchain. Bitcoin, first and most well-known blockchain application, uses a proof-of-work consensus algorithm to secure the network.

The Impact of Blockchain on Financial Infrastructure

The blockchain technology is disrupting the financial industry by creating new ways of doing business.

1. It Could Decrease the Need for Third-Party Approval for Transactions

One of the biggest benefits of the blockchain technology is that it could reduce the need for third-party approval for transactions. This would remove the need for middlemen, which would reduce costs and improve efficiency.

2. It Could Speed Up Transactions and Reduce Settlement Times

The blockchain technology could also speed up transactions and reduce settlement times. This would make it easier for businesses to execute transactions and reduce the amount of time needed to complete them.

3. It Could Eliminate the Need for Exchanges and Brokers

The blockchain technology could also eliminate the need for exchanges and brokers. This would reduce costs and improve efficiency, as well as allow businesses to interact directly with one another.

4. It Could Create a More Secure and Trusted Financial System

The blockchain technology could create a more secure and trusted financial system. This would reduce the chances of fraud and make it easier for businesses to operate securely.

The Application of Blockchain Technology in Finance

The application of blockchain technology in finance has been seen as a way to improve efficiency and security. The technology can help to reduce the cost of transactions, as well as the time it takes to complete them. It can also help to ensure that transactions are carried out correctly and without interference.

One example of how blockchain technology is being used in finance is in the settlement of derivatives contracts. These contracts can involve the exchange of digital assets, such as stocks or bonds. By using blockchain technology, it is possible to create a tamper-proof ledger of all transactions. This can eliminate the need for a third party to verify the accuracy of the data.

Another application of blockchain technology in finance is in the trading of securities. This involves the transfer of ownership of a security from one party to another. By using blockchain technology, it is possible to create a tamper-proof record of all transactions. This can eliminate the risk of fraud and ensure that the security is transferred correctly.

Finally, blockchain technology can be used to track the ownership of assets. This can help to prevent fraud and theft. It can also help to ensure that the assets are available when they are supposed to be.

The Implications of Blockchain for the Future of Finance

Blockchain technology is set to have a profound impact on the future of finance. Here are some of the implications:

1. More secure and transparent transactions:

The blockchain technology creates a more secure and transparent system for transactions. It eliminates the need for a third party, such as a bank, to verify and process transactions. This makes transactions more efficient and cheaper.

2. Greater efficiency and transparency in the financial system:

The blockchain technology will create greater efficiency and transparency in the financial system. It will make it easier for consumers to understand their finances and for businesses to conduct transactions with ease.

3. Increased investment opportunities:

The blockchain technology is likely to increase investment opportunities in the financial sector. This is because it provides a more efficient and secure system for conducting transactions. It is also likely to lead to the development of new financial products and services.