How to Use Crypto Trading Analytics to Make Better Trades

Crypto trading analytics can be used to help traders make better trades. This is done by analyzing historical data and trying to find patterns. Patterns can tell traders when to buy or sell cryptocurrencies.

There are many different crypto trading analytics platforms out there. These platforms allow traders to track a variety of different metrics. Some of the most popular crypto trading analytics platforms include Coinigy, TradingView, and Poloniex.

The first step in using crypto trading analytics is to set up your account with one of the platforms mentioned above. Once you have an account, you can start tracking your historical data.

When you are tracking your historical data, you want to pay attention to a few things. First, you want to track the prices of all of your cryptocurrencies. You also want to track the volumes of all of your cryptocurrencies.

You can also track other data such as the percentage of gains or losses that you have made over the course of your trading career. By tracking your historical data, you can find patterns that will help you make better trades in the future.

If you want to learn more about crypto trading analytics, you can check out some of our other articles on the subject.

The Benefits of Crypto Trading Analytics

Cryptocurrencies are digital or virtual tokens that use cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Cryptocurrencies are traded on decentralized exchanges and can also be used to purchase goods and services.

Cryptocurrency trading analytics provide insights into trends and movements in the market. These analyses help traders make informed decisions about where to allocate their capital and can help identify opportunities to make profits.

Some of the benefits of cryptocurrency trading analytics include:

1. Increased Profitability

Traders can benefit from increased profitability by using cryptocurrency trading analytics to identify opportunities to make gains. By monitoring the market and analyzing trends, traders can identify patterns that indicate where prices are likely to go next. This information can then be used to make investment decisions that lead to increased profits.

2. Increased Confidence

Cryptocurrency trading analytics can give traders a greater sense of confidence when making decisions about where to invest their money. By understanding the market, traders can avoid making costly mistakes and increase their chances of success.

3. Greater Accuracy

Cryptocurrency trading analytics provide greater accuracy by providing detailed information about trends and movements in the market. By understanding the technical indicators and charts associated with cryptocurrencies, traders can make more informed decisions about where to invest their money.

4. Increased Flexibility

Cryptocurrency trading analytics can provide increased flexibility by allowing traders to make informed decisions about when and where to trade. By understanding the market, traders can optimize their trading strategies to take advantage of opportunities.

5. Increased Speed and Efficiency

Cryptocurrency trading analytics can provide increased speed and efficiency by allowing traders to make informed decisions quickly. By understanding the market, traders can react quickly to changes and make informed decisions about where to invest their money.

The Basics of Crypto Trading Analytics

Crypto trading analytics is the process of tracking the movement of an asset over time and understanding the drivers of price action. By understanding these drivers, traders can make better informed decisions when trading cryptocurrencies.

There are a number of methods that can be used to track crypto trading analytics, including:

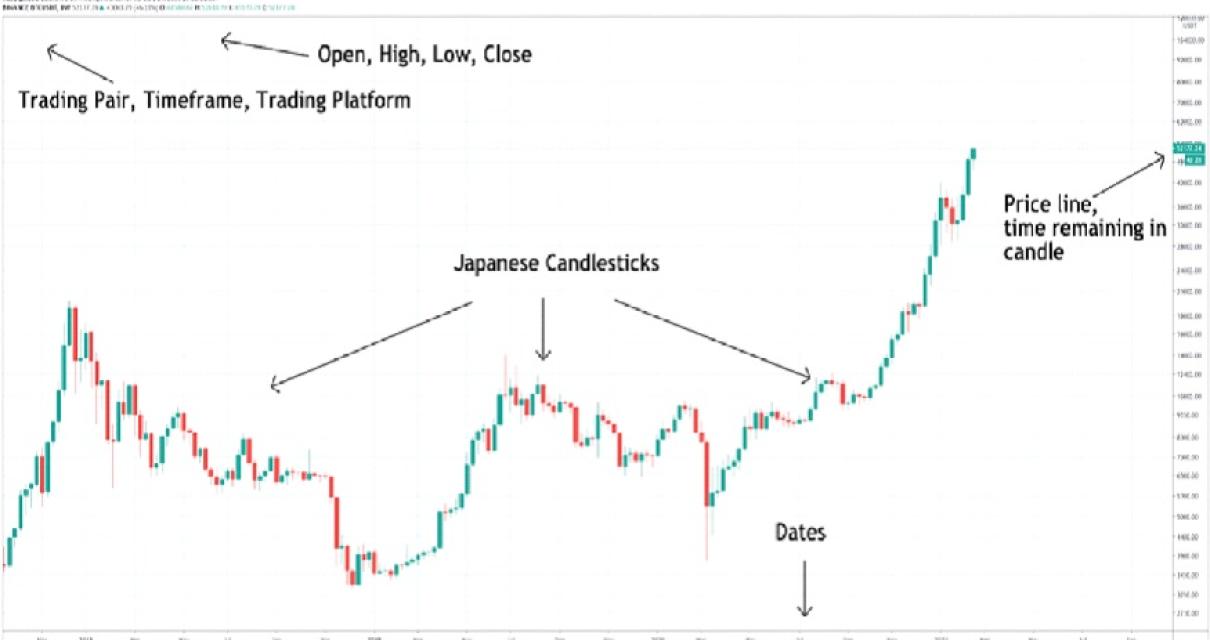

1. Tradingview: This platform is popular for traders because it offers a wide range of tools and features that can be used to analyze cryptocurrency prices. This includes tools that allow traders to track individual assets, as well as charts and graphs that can be used to visualize market activity.

2. CoinMarketCap: This site provides a comprehensive overview of cryptocurrencies by market cap, and also offers tools that allow users to track prices and volumes.

3. TradingView Charts: This feature allows traders to create their own charts and graphs that can be used to track cryptocurrency prices.

4. Crypto candlesticks: This feature provides a visual representation of the price action of an asset, and can be used to identify patterns and trends.

5. Crypto indicators: This feature allows traders to customize their own indicators to track specific aspects of market activity.

6. Cryptocurrency news: This feature provides real-time updates on the latest news related to cryptocurrencies, and can help traders make more informed decisions about market activity.

7. Crypto forums: This feature allows traders to interact with other traders and discuss cryptocurrency prices and trading strategies.

The Different Types of Crypto Trading Analytics

There are different types of crypto trading analytics, but they all share the same goal: to help you make better trading decisions.

1. Technical analysis

This type of analysis looks at technical indicators such as price, volume, and moving averages to predict future trends.

2. Fundamental analysis

Fundamental analysis looks at a company’s financial statements to determine its worth. It can also include looking at a company’s competitive landscape and its history of dividend payments.

3. Behavioral finance

Behavioral finance looks at how people make financial decisions, such as how risk-averse they are or how emotionally attached they are to their investments.

4. Statistical analysis

Statistical analysis uses numerical data to analyze trends and patterns. For example, it can help you identify patterns in market behavior or predict when a stock is likely to spike or crash.

The Pros and Cons of Crypto Trading Analytics

Crypto trading analytics can be a powerful tool for traders. However, there are also some potential downsides to using this technology.

Pros of Crypto Trading Analytics

Traders can use crypto trading analytics to gain an understanding of market trends and patterns. This can help them make better trading decisions.

Crypto trading analytics can help traders predict when a price will reach a certain level or trend. This can help them make profitable trades.

Crypto trading analytics can help traders identify potential opportunities in the market. This can help them increase their profits.

Crypto trading analytics can help traders identify potential risks in the market. This can help them avoid losses.

Cons of Crypto Trading Analytics

Crypto trading analytics can be time-consuming to use. This may limit traders' ability to trade frequently.

Crypto trading analytics can be expensive to use. This may limit traders' ability to make profitable trades.

How to Choose the Right Crypto Trading Analytics Tool

There are a number of different crypto trading analytics tools available, so it can be hard to decide which one to use. Here are some tips to help you choose the right one:

1. Look for a tool that has a wide range of features.

Some of the best trading analytics tools have a wide range of features, including tools that track prices, volumes, and news. This will help you get an overview of the current market conditions and make more informed decisions about your investments.

2. Look for a tool that is easy to use.

It is important that the tool you choose is easy to use. If it is difficult to understand or use, you may find it harder to make informed decisions about your investments.

3. Look for a tool that has a good user interface.

The user interface of a crypto trading analytics tool should be easy to use and intuitive. This will make it easier for you to track your investments and make informed decisions.

4. Look for a tool that has a good data tracking feature.

One of the key benefits of using a crypto trading analytics tool is the ability to track your investments and monitor their performance. Look for a tool that has a good data tracking feature so you can see how your investments are performing over time.

8 Cryptocurrency Trading Analytics Tools Compared

1. CoinMarketCap

CoinMarketCap is one of the most popular cryptocurrency trading analytics tools available. It allows traders to see the latest prices for all major cryptocurrencies, as well as detailed information on each one. CoinMarketCap also provides historical data for each coin, so you can see how prices have changed over time.

One downside of CoinMarketCap is that it is not specifically tailored to cryptocurrency trading. For example, it does not include information on specific exchanges where coins can be bought and sold. Instead, CoinMarketCap relies on data from CoinMarketCap.com, which is a general cryptocurrency data site.

2. Coinigy

Coinigy is another popular cryptocurrency trading analytics tool. It allows you to see the latest prices for all major cryptocurrencies, as well as detailed information on each one. Coinigy also provides historical data for each coin, so you can see how prices have changed over time.

One downside of Coinigy is that it is not specifically tailored to cryptocurrency trading. For example, it does not include information on specific exchanges where coins can be bought and sold. Instead, Coinigy relies on data from a variety of sources, including exchanges and market data providers.

3. TradingView

TradingView is another popular cryptocurrency trading analytics tool. It allows you to see the latest prices for all major cryptocurrencies, as well as detailed information on each one. TradingView also provides historical data for each coin, so you can see how prices have changed over time.

One downside of TradingView is that it is not specifically tailored to cryptocurrency trading. For example, it does not include information on specific exchanges where coins can be bought and sold. Instead, TradingView relies on data from a variety of sources, including exchanges and market data providers.

4. CoinigyPro

CoinigyPro is a paid version of Coinigy that offers additional features and benefits. For example, CoinigyPro allows you to track multiple cryptocurrencies at the same time, view live prices for coins in real time, and see detailed information on all your assets.

One downside of CoinigyPro is that it is not free. It costs $14 per month to use CoinigyPro, which is a significant investment if you only plan to use it for occasional cryptocurrency trading.

How to Create a Customized Crypto Trading Analytics Strategy

There are a few things you’ll need in order to create a customized crypto trading analytics strategy. The first is access to a cryptocurrency trading platform, such as Poloniex or Binance. Once you have access to the platform, you’ll need to find a cryptocurrency exchange that you’re comfortable trading on. You can find exchanges by searching for them on Google or by using a cryptocurrency exchange aggregator. Once you have an exchange chosen, you’ll need to find a cryptocurrency to trade. You can find cryptocurrencies by searching for them on Google, by using a cryptocurrency exchange aggregator, or by using cryptocurrency charts. Once you have a cryptocurrency chosen, you’ll need to find an analytical tool. You can find analytical tools by searching for them on Google or by using a cryptocurrency exchange aggregator. Once you have an analytical tool chosen, you’ll need to find a crypto trading strategy. You can find crypto trading strategies by searching for them on Google or by using a cryptocurrency exchange aggregator. Once you have a crypto trading strategy chosen, you’ll need to create a custom trade analysis. You can create a custom trade analysis by searching for a template on Google or by using a cryptocurrency exchange aggregator.