How to Implement Blockchain in Insurance

There is no one-size-fits-all answer to this question, as the implementation of blockchain in insurance will vary depending on the specific needs of the company. However, some tips on how to implement blockchain in insurance include:

1. Evaluate the current system. First, it is important to evaluate the current system in order to determine if blockchain can be used to improve it. This evaluation will help to determine the specific needs of the company and the best way to implement blockchain.

2. Create a pilot project. Once the needs of the company have been determined, a pilot project can be created to test the feasibility of using blockchain in insurance. This pilot project should include a thorough evaluation of the existing system and the implementation of blockchain technology, in order to ensure that the benefits of using blockchain are realized.

3. Explore the potential benefits of blockchain. Once the pilot project has been completed, it is important to explore the potential benefits of using blockchain in insurance. This exploration will help to determine if blockchain is the right solution for the company and identify any potential issues that may need to be addressed.

4. Launch a full implementation. Once the benefits of using blockchain in insurance have been fully understood, a full implementation can be launched. This implementation should include the development of a blockchain platform, as well as the establishment of a team of experts to manage and operate the platform.

The Benefits of Blockchain in Insurance

There are many benefits of blockchain in insurance. These include:

Reduced Costs

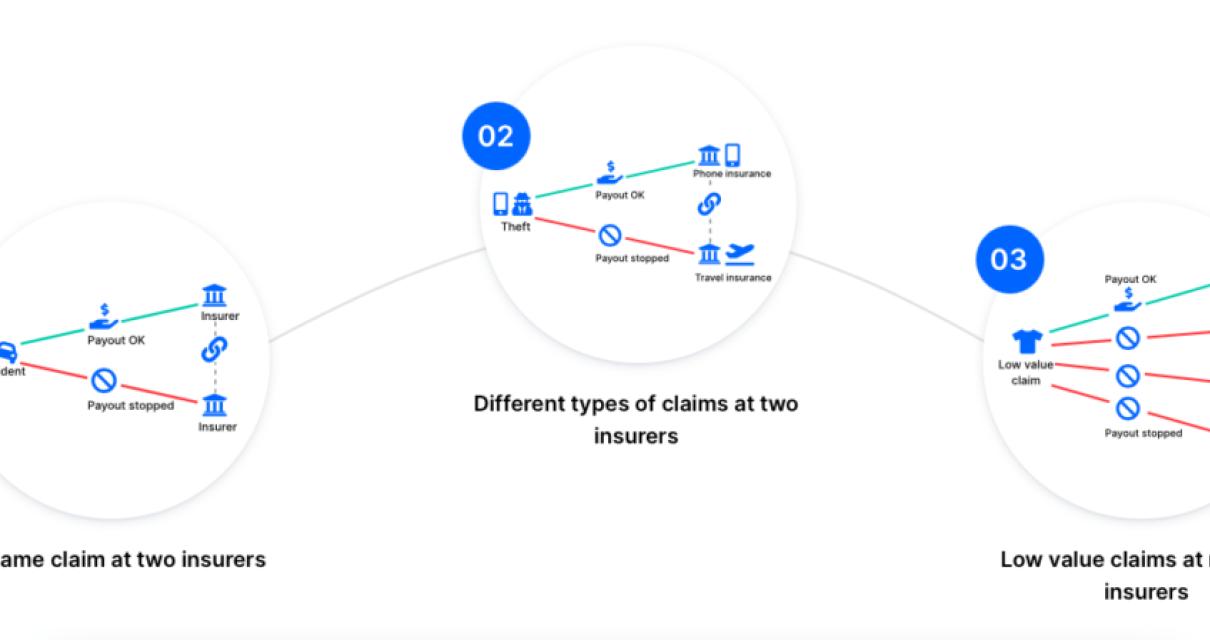

Blockchain can help to reduce costs by streamlining the process of verifying and tracking information. This can help to speed up the process of approving claims and reducing the number of errors made.

Improved Transparency

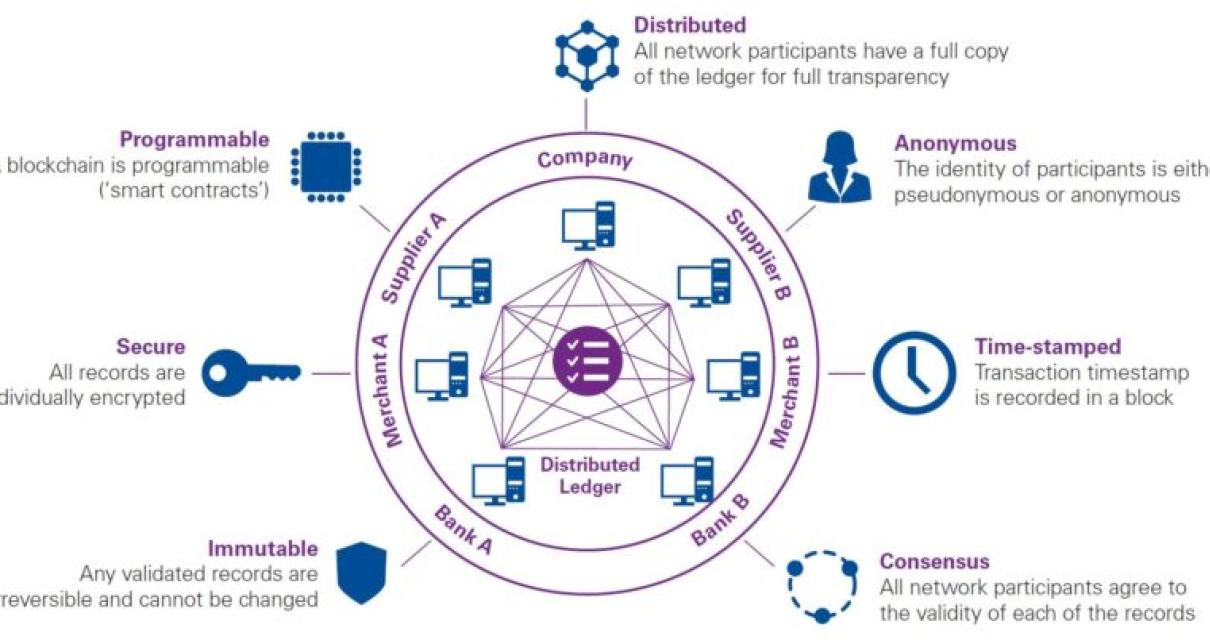

Blockchain technology can help to improve transparency by ensuring that all relevant information is available to participants. This can help to reduce the risk of fraud and ensure that everyone involved in a transaction is aware of the details.

Efficient Processing

Blockchain technology can help to speed up the processing of insurance transactions. This can help to reduce the time it takes to approve claims and make payments.

Increased Security

Blockchain technology can help to increase security by ensuring that all data is secure and tamper-proof. This can help to protect against fraud and protect the identities of individuals involved in a transaction.

The Risks of Blockchain in Insurance

1. The susceptibility of blockchain to fraud and cybercrime.

2. The potential for blockchain networks to be hacked, resulting in the theft of personal data or the loss of money.

3. The potential for blockchain to be used for fraudulent activities such as money laundering or investment scams.

4. The potential for blockchain to be used to create fake insurance products or to increase the costs of insurance premiums.

5. The potential for blockchain to reduce transparency and confidentiality in the insurance sector, making it easier for criminals to steal information.

6. The potential for blockchain to create a new class of “insider” insurance brokers who are able to exploit the technology for their own benefit.

7. The potential for blockchain to create a new form of “shadow insurance”, where policies are not actually sold to customers but instead are traded between brokers in an opaque manner.

8. The potential for blockchain to lead to a fragmentation of the insurance market, with different insurers offering different types of policies and services.

9. The potential for blockchain to create a new breed of insurance “schemes” that are not subject to regulation or oversight.

10. The potential for blockchain to increase the costs of insurance products and services.

The Costs of Blockchain in Insurance

There are a few potential costs of blockchain in insurance. The first cost is the potential for increased security and accuracy of data. Blockchain technology can help to ensure that data is accurate and secure, leading to improved customer experience and reduced fraud.

Another cost is the potential for increased transparency and accuracy of claims processing. Blockchain can help to ensure that all relevant data is available for review, leading to improved accuracy and speed of claims processing. This could benefit both insurers and policyholders, as it could lead to reduced insurance costs and increased satisfaction with the insurance process.

Overall, there are a number of potential costs associated with blockchain in insurance. However, these costs could lead to positive changes in the way that insurance is processed, providing benefits for both insurers and policyholders.

The Future of Blockchain in Insurance

The future of blockchain in insurance is bright. Blockchain technology has the potential to revolutionize the way insurance is delivered and managed, making it more cost-effective and efficient.

Already, a number of insurance companies are exploring how blockchain can be used to improve their operations. For example, Lloyd’s of London is using blockchain to track and trace goods as they move through the supply chain. And AIG is using blockchain to automate insurance claims processing.

As blockchain technology continues to evolve, it is likely that we will see even more insurance companies adopt it in order to improve their operations. In particular, blockchain could help to:

Reduce the costs associated with insurance

Streamline the process of insurance claims processing

Create a more transparent and secure system

If you are interested in learning more about how blockchain could be used to improve your business, please contact our team. We would be happy to discuss how blockchain could benefit your organization and help you to achieve your goals.

The Pros and Cons of Blockchain in Insurance

There are a few pros and cons of using blockchain technology in the insurance industry, depending on the specific use case. Some potential benefits include:

Improved transparency and trust: Blockchain is an open, distributed ledger that can be used to securely record and track transactions. This makes it an ideal technology for recording and tracking insurance claims, payments, and other interactions between insurers and policyholders. It also enables insurers to monitor transactions more closely and verify the accuracy of data entries.

Blockchain is an open, distributed ledger that can be used to securely record and track transactions. This makes it an ideal technology for recording and tracking insurance claims, payments, and other interactions between insurers and policyholders. It also enables insurers to monitor transactions more closely and verify the accuracy of data entries. Reduced costs: Blockchain technology can help reduce the costs associated with managing insurance contracts, such as fraud prevention and contract management. In addition, it can help insurers reduce the time it takes to process claims.

Blockchain technology can help reduce the costs associated with managing insurance contracts, such as fraud prevention and contract management. In addition, it can help insurers reduce the time it takes to process claims. Increased security: Blockchain is a secure platform that can help protect against fraud and cyberattacks. It also enables insurers to monitor transactions more closely to ensure that policyholders are actually paying for coverage they've purchased.

There are also some potential drawbacks to using blockchain in the insurance industry. Some of these include:

Limited scalability: Blockchain is not well suited for handling large volumes of data. This means that it may not be able to handle the high demand for insurance services that is likely to arise in the future.

Blockchain is not well suited for handling large volumes of data. This means that it may not be able to handle the high demand for insurance services that is likely to arise in the future. Limited application: Blockchain is currently mainly used in the financial sector. It has yet to be widely adopted in other industries, including insurance. This could limit its usefulness in this area.

Overall, there are several positive aspects and limitations to using blockchain in the insurance industry. It will likely continue to grow in popularity as more companies explore its potential benefits.

How You Can Use Blockchain in Insurance

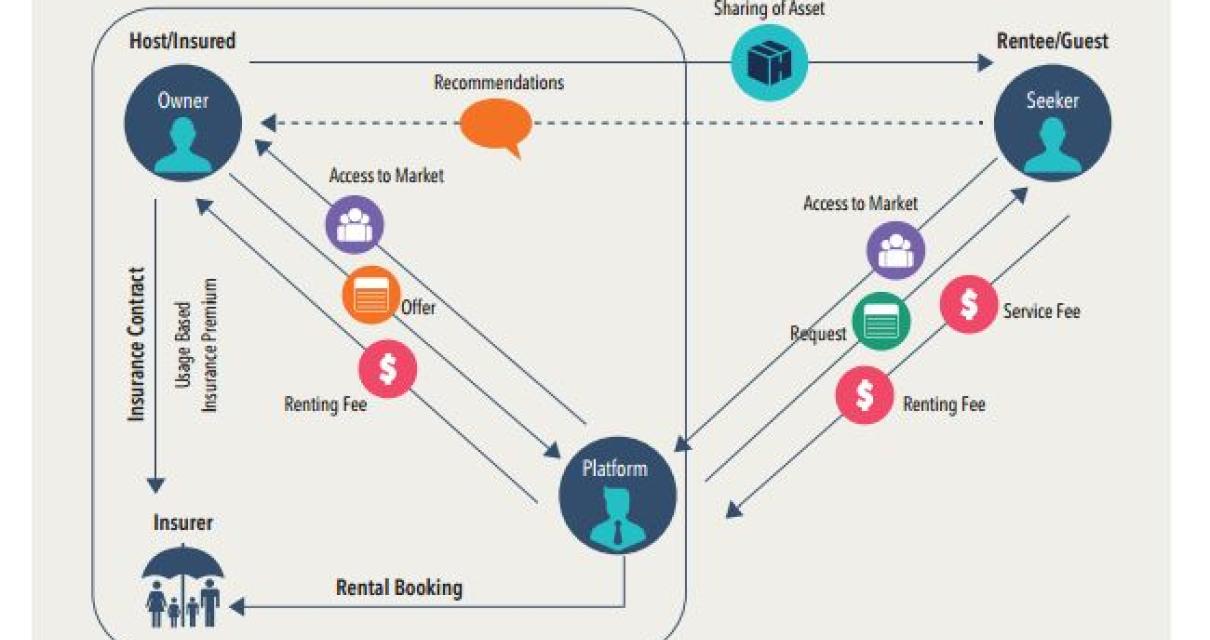

There are a few ways you can use blockchain in insurance. One way is to use it as a tamper-proof ledger. This would allow you to track the history of insurance claims and payments. Another way is to use it as a secure database for policy information. This would allow you to keep track of policies and their details. Finally, you could use it to create a trustless network for peer-to-peer insurance interactions. This would allow you to bypass the traditional insurance system and provide insurance services directly to customers.

What is Blockchain in Insurance?

Blockchain is a distributed database that allows for secure and transparent transactions between parties. In the insurance industry, blockchain could be used to manage claims and payments, as well as track risks.

How Does Blockchain Work in Insurance?

As mentioned earlier, blockchain technology is used to create a tamper-proof ledger of all insurance transactions. This ledger can be accessed by all participants in the insurance ecosystem, allowing for more efficient and transparent processes. Additionally, blockchain technology can help to eliminate the need for third-party verification of insurance transactions, which can lead to cost savings for insurers.

Who is Using Blockchain in Insurance?

There are a few companies currently using blockchain in the insurance industry. These include insurtech startup Everledger, software company CertiKx, and global reinsurance company Swiss Re. These companies are using blockchain to create a tamper-proof record of insurance contracts, prevent fraud, and improve transparency.

What are the Advantages and Disadvantages of Blockchain in Insurance?

The advantages of using blockchain technology in insurance are that it is secure, transparent, and tamper-proof. Additionally, it allows for faster settlement times and reduced processing time. The disadvantages of using blockchain technology in insurance are that it is expensive to implement, and there is a lack of standardization.

Is Blockchain Right for My Insurance Business?

Blockchain technology is a distributed database that allows for secure, low-cost transactions between parties. It could be a good fit for your insurance business if you want to reduce costs and improve efficiency. For example, you could use blockchain to track claims and payments, create a tamper-proof record of events, or manage insurance claims data.