How Crypto Lending Works: The Basics

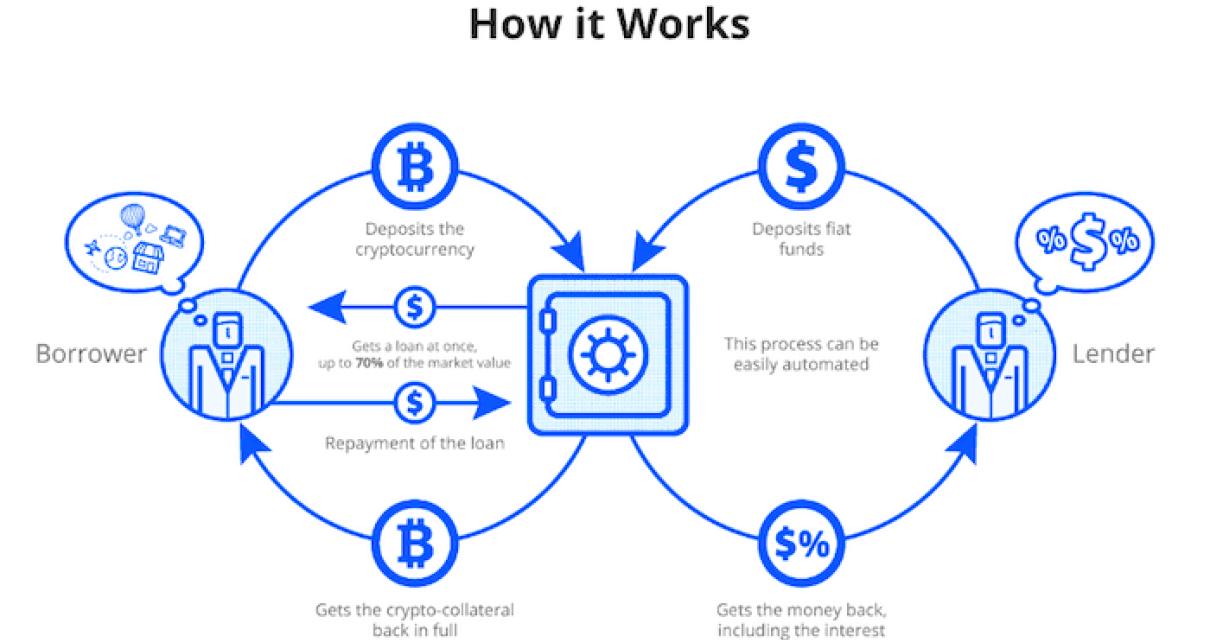

Crypto lending is a way for people to borrow money using cryptocurrencies. The borrowers use the coins to pay back the lenders, who then get their original investment back plus interest.

There are a few different types of crypto lending, but the most common is peer-to-peer lending. This means that borrowers and lenders connect directly with each other, without any middleman.

Peer-to-peer lending is a relatively new phenomenon, and there are still some kinks to be worked out. For example, borrowers and lenders can sometimes be difficult to contact, and there’s always the risk of fraud.

However, overall, crypto lending is a promising new industry, and there are already a number of successful companies operating in this space.

How Crypto Lending Can Help You Grow Your Investment Portfolio

Crypto lending is a new way to borrow money in the cryptocurrency market. It allows you to borrow money from other people in the crypto community, and pay them back with cryptocurrency.

This is a great way to get started in the crypto market, and to grow your investment portfolio. Crypto lending is a way to get exposure to new cryptocurrencies, and to invest in projects that you may not have been able to invest in otherwise.

Crypto lending also allows you to get access to high-quality projects that you may not be able to find on the stock market. You can also earn interest on your investment, which can add additional income to your portfolio.

If you are interested in getting started in the crypto market, or in growing your investment portfolio, crypto lending may be the perfect option for you.

The Benefits of Crypto Lending

Crypto lending is a new, innovative way to borrow money that uses cryptocurrency as the payment method. This service allows you to borrow money from a lender who will return your money in cryptocurrency, which can then be traded or used as currency.

Some of the benefits of using crypto lending include:

The ability to borrow money with minimal interest rates.

The ability to borrow money from a lender who has a wide range of lending options.

The ability to borrow money from a lender who is located in a different country than you.

The ability to borrow money from a lender who is trustable and reliable.

The ability to borrow money from a lender who has a good reputation.

The ability to borrow money in a fraction of the time that it would take to borrow money from a traditional bank.

The ability to borrow money without having to provide any documentation or proof of income.

How to Get Started With Crypto Lending

If you are interested in getting started with crypto lending, there are a few things you will need to do first. First, you will need to create an account with a crypto lending platform. Once you have an account, you will need to deposit some cryptocurrency into your account. You can either purchase cryptocurrency directly from exchanges or use a cryptocurrency wallet to deposit funds. Once you have deposited cryptocurrency into your account, you will need to create a loan.

To create a loan, you will first need to select the currency you want to loan in. Next, you will need to specify the amount of cryptocurrency you want to loan and the duration of the loan. Finally, you will need to submit your loan request. The platform will then conduct a due diligence process and decide whether or not to approve your loan. If your loan is approved, the platform will then transfer the requested cryptocurrency to your account.

5 Tips For Successful Crypto Lending

1. Do your research.

Before lending any money to a crypto project, be sure to do your research. There are numerous scams out there, and it’s important to be sure that the project you’re investing in is legitimate.

2. Only lend to trustworthy projects.

Only lend money to projects you trust. There are a lot of shady actors out there, and it’s important to make sure you don’t get scammed.

3. Be patient.

Don’t expect to get your money back immediately. Crypto projects tend to take a bit longer than traditional projects to reach their milestones, so be patient.

4. Don’t invest more than you can afford to lose.

Crypto projects are volatile, and it’s possible that the value of your investment could decrease rapidly. Make sure you are comfortable with the risk involved before investing any money.

5. always do your own research.

How to Maximize Your Returns With Crypto Lending

Crypto lending is a new and growing market that allows you to borrow cryptocurrencies, and then lend them out to other users. This allows you to earn interest on your crypto loans, and also allows you to get exposure to new cryptocurrencies while still keeping your holdings safe.

To maximize your returns with crypto lending, there are a few things you should keep in mind.

1. Research the Top Crypto Lenders

When researching crypto lenders, it is important to carefully consider the different options available. There are a number of reputable lenders out there, but it can be difficult to determine which ones are the best for you.

2. Choose a Crypto Lender with a Good Reputation

One of the most important factors to consider when choosing a crypto lender is their reputation. Look for lenders with positive customer reviews, and make sure to do your own research to ensure that the lender you choose is reputable.

3. Pay Attention to Interest Rates and Fees

It is important to pay attention to interest rates and fees when borrowing cryptocurrencies. Many lenders offer high interest rates, but also charge high fees. It is important to compare different options and find a lender that offers the best rates and fees possible.

4. Make Sure to Protect Your Cryptocurrency Holdings

It is important to make sure that you protect your cryptocurrency holdings when borrowing them through a crypto lender. Do not leave your coins unsecured in any account, and make sure to use a secure password for your account.

5. Monitor Your Lending Progress Regularly

It is important to monitor your lending progress regularly. This will allow you to track your earnings and make sure that you are getting the best possible return on your investment.

What to Look for When Choosing a Crypto Lending Platform

When looking for a crypto lending platform, it is important to consider the following factors:

The platform’s features: The platform should offer a wide range of features, including the ability to borrow and lend cryptocurrencies, track loan progress and payments, and access a range of lending services.

The platform’s liquidity: The platform should have a high liquidity level, meaning that there is a large number of available loans.

The platform’s safety and security: The platform should have a strong security and safety system, which includes features such as identification verification and credit ratings.

The platform’s fees: The platform should have low fees, which will make it more affordable for borrowers and lenders.

The Risks of Crypto Lending

Crypto lending platforms are a great way for investors to get exposure to a variety of cryptocurrencies. However, there are a number of risks associated with crypto lending.

One risk is that the borrower may not be able to repay the loan. This can happen if the borrower defaults on the loan or if the cryptocurrency price falls significantly.

Another risk is that the crypto lending platform may go out of business. If this happens, investors may lose their investments.

Finally, crypto lending platforms may be subject to fraud. This can happen if borrowers misrepresent their financial situation or if the crypto lending platform is used to launder money.

How to Avoid Common mistakes When Lending Cryptocurrency

When lending cryptocurrency, it is important to be aware of the common mistakes people make. Some of the most common mistakes include:

Not knowing what the collateral is worth.

Not taking into account the interest rates.

Not being aware of the risks.

Not being able to repay the loan on time.

Not being aware of the cryptocurrency market volatility.

5 Expert Tips for Successful Crypto Lending

1. Do your research. Don’t just take anyone’s word for it when it comes to crypto lending. Do your own research and ask around before getting involved.

2. Only invest what you can afford to lose. While crypto lending can be a profitable investment, it is also risky. Make sure you are comfortable with the risks before getting involved.

3. Be patient. It can take some time to find good crypto loans, so be patient and keep your eyes open.

4. Pay attention to the news. Keep up to date with the latest news and developments in the crypto world, as this can affect the prices of coins and tokens.

5. Have a solid strategy. Having a strategy for investing in crypto loans can help you make better decisions.